How much life insurance do you need? …..and Risk and Uncertainty

The rule of thumb for the amount of life insurance one needs is typically given as 10x (ten times) annual gross income. In fact things are a little more complicated than that. The required life insurance is not about replacing the value of the life time earning power of the insured, but rather replacing the value of that earning power to those who benefit from and/or are reliant upon it (i.e. remaining family). So rather than just using 10x income, after some analysis, as we’ll see, the requirements may range from no insurance required to 10-15x gross income or even higher, depending on the approach/assumptions used to generate the estimate and the degree of conservatism one wants to be in withdrawal strategy and portfolio risk.

Risk, Uncertainty and Insurance

Before we discuss life insurance needs, let’s first talk about risk, uncertainty and insurance in general.

George Rejda’s textbook on “Principles of Risk Management and Insurance” is highly recommended to those who are interested in an in-depth look at the complex subject of risk and insurance. I will draw extensively, though not exclusively, from his textbook for this blog.

Uncertainty refers to not being sure of an outcome (good, bad or indifferent), whether it will occur or not, and the size/extent of the occurrence or even statistical properties of an outcome. Rejda defines risk as the “uncertainty of occurrence of a loss”. So this means that for a life insurance company that insures hundreds of thousands of individuals and has good historical longevity information, the death of an individual is not really a risk however the uncertainty of statistics associated with the variability of mortality of its insured population compared to the historical/assumed statistics is the risk. For a very large population of insured individuals over an extended period of time, the risk is then small and is covered by the insurance company pricing including some contingency for the risk of reversal in current increasing longevity trends. Thus the insurance company can assume the risk of unknown/premature death of an individual because, for a large number of insured, the loss is (largely) predictable and can be priced accordingly. However for an individual with a couple of young children, who earns all or the vast majority of his/her family’s income, the financial impact associated with his/her death can be devastating on the remaining family; and the risk of premature death is significant (half the people of a certain age die before the age indicated in mortality tables).

Let me digress a little by paraphrasing a quote attributed to Donald Rumsfeld which essentially says that:

1-There are things that we know that we know- known knowns (e.g. we know that we’ll all die)

2-There are things we know that we don’t know- known unknowns (e.g. we know that we’ll die, but we don’t know when ; in Taleb’s book “The Black Swan” he calls this world ‘mediocristan’, represented by physical things like the longevity, height or weight distribution of people- in this world, outcomes can be represented by something like a normal distribution)

3-There are things that we don’t know that we don’t know- unknown unknowns (e.g. Black Swans in Taleb’s lingo, things that we don’t even think of in the realm of possibility; he calls this world ‘extremistan’ and he gives financial markets as a prime example- where he believes that for investors the expected outcome is less important than the worst case outcome. He therefore thinks that using a normal distribution to model financial markets is inappropriate.

According to one categorization, risk comes in two flavors: (1) pure risk (where “there are only possibilities of loss and no loss”) and speculative risk (where “either profit or loss is possible”). Pure risk in turn can be: personal (e.g. death, disability), property (e.g. automobile, home) or liability (e.g. payment for damages inflicted on somebody as a result of something that you may have or have not directly done). He also discusses the difference between insurance and hedging; in both cases there is a transfer of risk, in one case to an insurance company and the other to a speculator. In case of hedging the speculator typically assumes an uninsurable risk, like locking in a guaranteed sale price for a wheat crop due in six months (among the requirements for a risk to be insurable is that (the insurer’s) loss must be “determinable and measurable”, so it’s not an insurable risk). In hedging, unlike in insurance where exposure to more (insured) customers reduces insurance company risk, there is no risk reduction with increase in number of units; there is only risk transfer. By the way, he also discusses the difference between insurance and gambling: in gambling, unlike in insurance which deals with an already existing risk, a new speculative risk is created, and “gambling is socially unproductive, because the winner’s gain comes at the expense of the loser.”

Insurance

In my Life-cycle Investing blog , which is built on the observation that during the working life of an individual, one’s total capital is composed of ‘human’ and ‘financial’ capital and, as the individual ages, typically the mix gradually shifts from all human to all financial capital. I also discussed in that blog some of the changing risks that an individual/family is exposed to: disability, death, investment/market risk, longevity risk and inflation. Some of these may be mitigated with insurance, while others with hedging or diversification.

For a married individual with small children, who earns all or the vast majority of his/her family’s income, the financial impact associated with his/her death can be devastating on the family’s finances. At this stage in the lifecycle the vast majority of the family capital is in the form of human capital (i.e. ability to earn an income over decades). If the primary breadwinner dies at this stage without adequate life insurance to replace the human capital, the family capital is essentially wiped out.

The major categories of insurance that should be considered in all financial plans include:

-property- home, automobile,

-personal- life, health (especially for Americans), disability, long-term care, critical illness

-liability- protect against legal liability due to bodily injury or property damage (included in home and automobile policies and additional coverage is available via Personal Umbrella Coverage)

There is generally a trade-off between cost of insurance and the deductible/co-insurance one assumes (not applicable to life, critical illness or liability policies). Ideally insurance should be bought for catastrophic losses or losses that the individual could not reasonably deal with. So to minimize cost usually it makes sense take as high a deductible as tolerable. One of the characteristics of insurance is ‘indemnification’ i.e. “that the insured is restored to the approximate financial position prior to the occurrence of the loss”; i.e. you that you shouldn’t make a profit on the insurance payout, though this does not apply to life insurance.

You can read more about insurance and risk in the following Florida State University course on Insurance

Life Insurance

I want to focus the balance of this blog on life insurance and specifically on the subject of how to determine how much insurance you need.

Life insurance is also one of the few insurance products where there may be a bundled investment component with the insurance component. So it usually comes in two broad forms:

-pure life insurance: term life (usually this is the preferred approach of buying life insurance- investments can be dealt with as a separate activity) .

-life insurance bundled with investment/saving component: whole life (occasionally it may be appropriate if you expect to need lifetime protection, though I am generally inclined to the use of term insurance), variable life, universal life (the investment component is usually ‘sold’ as being advantageous due to it being tax-free, however their benefit is questionable once one factors in the various and considerable sales/management fees associated with these products).

Insurance needs vary not only among individuals but also over the lifetime of one individual. As indicated earlier, term insurance is pure insurance, without a savings or investment component. Term insurance has the advantages of:

1. cheapest (especially when need is the greatest like in the case of young family dependent on human capital),

2. protection is temporary (or higher required protection is temporary, as when there are young children) and

3. guaranteeing insurability (conversion privilege)

Term insurance comes in a number of flavors:

1. renewable term (providing coverage for one year at a time with option to renew without evidence of insurability, and the rate increases annually commensurate with the death rate increases with age and eventually becomes prohibitive- not a mechanism to buy lifetime coverage)

2. 5, 10, 15 or 20 year term- typically the premiums are level during the specified term and after which policy may usually be renewed at a higher rate.

3. Term to 65- policy expires at age 65, prior to which there usually is an option to convert to a permanent (whole) life policy.

4. Decreasing term- the face value of the policy declines over time (e.g. with decreasing needs as an outstanding mortgage declines or accumulated assets increase)

4. Reentry term- allows a lower cost insurance if insured can periodically demonstrate insurability (usually a medical questionnaire and some form of medical exam)

Another type of insurance, is second to die life insurance, which is significantly cheaper, and is useful to cover expenses incurred when the second of a couple dies U.S. estate taxes or Canadian capital gain taxes must be paid. Also, upon the death of the second of a couple remaining assets in tax deferred accounts (e.g. RRSPs/RRIFs or 401(k)s) are taxed at income rates. Furthermore, investment accounts and vacation homes that have appreciated will require payment of capital gains taxes on the appreciation. If there are insufficient liquid or easily liquefied assets, the heirs may have to involuntarily sell vacation homes or sell financial assets when markets are down.

Other insurance consideration would be availability of group insurance. If it is from your employer then it may be especially advantageous if you would have trouble passing an insurability test and none is required. Other type of a group is affinity (e.g. professional association, college Alma Mater) based, where the cost tends to be lower than for individual policy, due to lower sales/marketing costs.

Price of life insurance is not the only consideration. You should factor in is the financial strength of the insurance company and the selection of a competent insurance agent.

How much life insurance do you need?

The standard answer to this question is ten times annual income. This may be a good start, but the amount of needed insurance is really more context specific, i.e. more dependent of the current and future income/expenses/assets/circumstances of the insured and his/her(extended) family and other objectives of the insured (e.g. estate).

There are three approaches to determining the amount of life insurance that you need according to Rejda:

1. Human value– “present value of the family’s share of the deceased breadwinner’s future earnings”. The human value is calculated as: estimated average annual earnings until expected retirement, reduced by taxes and (incremental) expenses for self-maintenance of the insured then multiplying by the number of working years and discounting appropriately to calculate present value. Ideally one could build in other income sources, real earning increases and inflation.

2. Needs based– “various family needs that must be met if family head should die” (It can actually be broader than that as there can be significant financial loss resulting even when a homemaker spouse dies). This approach includes estimation of future expected needs of the remaining family: estate clearance (burial, uninsured medical debts, income taxes, and estate taxes/fees), income during readjustment (1-2 years), income during dependency (until youngest child reaches 18), life/retirement income for surviving spouse, and special needs (mortgage, education, emergency).

3. Capital retention (capital needs)- “unlike the needs approach which assumes liquidation of the life insurance proceeds, the capital retention approach preserves the capital needed to provide income for the family. The income producing assets are then available for distribution later to the heirs.” The capital retention approach involves: determining additional assets, on top of currently available assts for income generation (i.e. need to prepare a balance sheet to identify available income producing assets), required to generate the needed family income after death of one spouse.

Let’s now look at some specific situations to get an idea on how good the ten times annual gross salary rule of thumb really is. As you’ll see 10x may be a simple rule of thumb, but the right answer may be anywhere from 0x (you have no need for insurance) to 20-25x (if you use a ‘capital retention’ approach and want to use a very conservative withdrawal rate).

In most of the following cases (unless explicitly indicated otherwise) we’ll assume that:

-35 year old couple earning $65K and $40K

-inflation = 3%

-salary increases = inflation + 2%

-economic value or replacement cost of homemakerspouse = $30,000/year

-discount rate for present value of future cash streams = 5%

-retirement age (expected) = 60

-incremental cost of self-maintenance of husband or wife = 15% of after tax income (this is amount by which family expenses are reduced if one dies – used in the ‘human value’ approach of calculation life insurance needs

-effective tax rate = 20%

-Mortgage outstanding= $200K

-University Education fund desired= $100K

-Current accumulated savings= $100K

-Children aged 3 and 5

Examples of “how much life insurance do you need?”

Let’s finish off with a few illustrative examples to give you an idea how you might guesstimate better your family’s life insurance requirement. It can be more complicated than 10x time gross income, but that’s a good start. In what follows you obviously have to enter your own applicable numbers/estimates and judgments (since the assumptions including inflation, withdrawal rate, assumed portfolio risk and other factors can all effect the outcome). Also, note that in life insurance it is not about replacing the value of the earning power of the insured, but rather replacing the value of that earning power to those who benefit from and/or are reliant upon it (i.e. remaining family).

Case 1– Independent single male or female age 25 earning $65K with no dependents:

Life insurance requirements are minimal; essentially cover funeral and residual expenses (uninsured or deductible/copayment medical), say less than $100K.

Case 2– Young married couple: age 30, no children, no mortgage each making $65K/year and $40k/year

This is very similar to case 1, above perhaps with adjustment for embedded lifestyle paid for with dual incomes.

Case 3– Young family: parents 35, children 3 and 5, earning $65K and $40K, mortgage $200K, retirement savings $100K.

The detailed calculation of the estimated life insurance needs are given below in the Appendix: Case 3- Detaled Calculations section

Case 4– Young family: parents 35, children 3 and 5, one breadwinner $105K, mortgage $200K, retirement savings = $100K.

This is very similar to Case 2 for working/breadwinner spouse (about $1,000K or 10x gross income). For the homemaker spouse, the insurance requirement could be at least $200K (at least enough to cover outstanding mortgage of $200K , thus the eliminated mortgage expenses could pay for new childcare expenses), while the upper end requirement is $600K for replacement cost of housekeeper/babysitter/nanny.

Case 5– 65 year old retired couple with assets $500K living on a single pension of $40K and have $60K pretax expenses ($20K requirement above the pension is covered by 4% draw from $500K portfolio). If pensioner spouse dies, the pension is reduced to60% or$24K, creating a $16K annual pretax shortfall. Assuming expenses reduce by 8K with the death of the pensioner spouse, then the pensioner spouse would need to buy $200K life insurance. This 200K would conservatively allow 4% or $8K annual draw to make up the remaining shortfall.

Appendix: Case 3- Detailed Calculations

Then consider the three approaches recommended by Rejda to calculate life insurance needs:

1. Human Value of a Breadwinner in a Family Context

This is essentially the PV (present value) of lifetime income (annual increases of inflation (3%) plus 2% assumed) of an individual reduced for tax (25% of gross assumed) and self-maintenance (15% of after tax assumed). A discount rate of 5% was assumed. For a 35 year old earning $65K/year this can be calculated to be: $884K, $1,105K and $1,326Kassuming retirement (stop work) at age 55, 60 and 65 respectively.

For the 35 homemaker spouse whose annual replacement cost is $30K/year the PV (present value) assuming 3% increase in value per year and a 5% discount rate results in: $500K, $590 and $680Kover 25, 30 and 35 years (or age 55, 60 and 65) respectively.

2. Capital Retention/Needs Approach

Here the objective is to generate the necessary capital so that when drawn down at 5%/pear will meet family’s income requirements, substantially preserving the (nominal value of the) capital for the estate.

Assuming the spouses earn $65K and $40K respectively, and they pay $25K tax and save $22K per year (i.e. expenses are $58K/year), then calculation is as follows for the $65K and $40K earners:

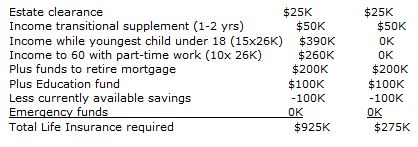

3. Need Based Approach

Here unlike Capital Retention approach, the capital is liquidated. As before we assume that mortgage will be retired and there is a $10K/year and 5K/year CPP/SS Survivor Benefit and $100K accumulated savings, then we could analyze needs in different phases of life. Here the simplifying assumption is that inflation and discount rate effectively cancel each other so we can just deal with current dollars (a pessimistic assumption), then

(Note that annual expenses (of $26K after-tax and $33K pre-tax) can be expected to be funded by drawing 5% from 650K ($390K+$260K) without affecting the nominal value of the capital. So, assuming that in retirement the expenses stay about the say (or lower) plus Social Security or Canada Pension Plan income the needs will likely be continue to be met by the withdrawals of 5% of end of previous year’s portfolio value . Of course occasional ups and downs in the market will lead to higher or lower annual draws, but it may be a workable approach.)

In this case, whatever the approach used, the insurance required for the primary breadwinner, assuming that, after death, the surviving spouse stays home while children are less than 18, is about 15x gross income. The Table in Case 3 above summarizes the results of the various alternatives to calculating life insurance needs.

So much info! Hard to grasp…

Sorry about the complexity of this old blog post…no doubt it could be made simpler today…enjoy…peter